Service Hubs: One-Stop Centres to Cater for Farmers’ Needs More Effectively

What is the Innovation?

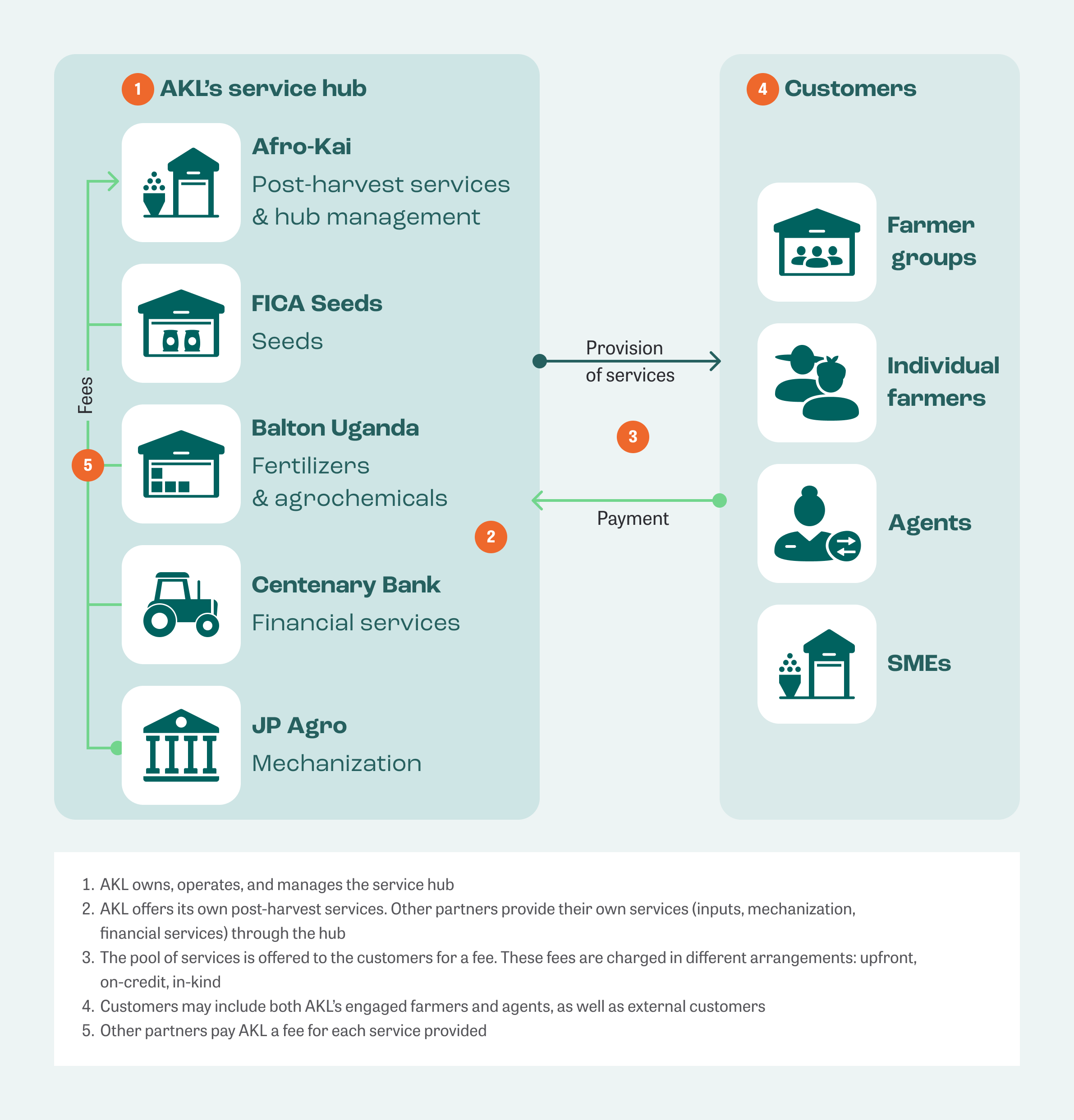

The hubs are ‘one-stop shop’ infrastructures (i.e., weighbridge; drying, cleaning, and packaging facilities; and warehouses) owned and operated by a company or organization. The hubs facilitate farmers, SMEs, and businesses to access several agricultural services. The services are offered by the owner and/or other partner provider(s), and can include inputs, post-harvest services, mechanization, financial services, extension, etc. The different providers charge the customers for accessing their good or services. If these are offered by the partner providers (other than the owner), the hub owner receives a commission for each transaction, contributing to the financial self-sufficiency of the hub. The hubs are also known as Grain Trade Business Hubs, GHubs, and G-Hubs.

Key Challenges Addressed

Afro-Kai Limited (AKL) started sourcing directly from smallholder farmers in the last 2 years. AKL engaged with farmers in far-away districts, who at times do not have access to agricultural services nearby like inputs, mechanization, post-harvest, and markets. Lacking those services, farmers experience frustration, lower yields, and economic losses. Such inefficiency ultimately affected AKL’s sourcing capacity in quantity and quality. Besides, AKL had set up two storage and processing facilities (in Purongo- Nwoya District in Northern Uganda and Kasese areas) that remained underutilized. To effectively tackle the challenges of underserved farmers, unmet sourcing targets, and underused infrastructure, AKL revamped its facilities as one-stop hubs offering several agricultural services. This win-win strategy is expected to improve the cost-efficiency of AKL’s infrastructure while delivering a better service proposition to the farmers.

How it Works

Tips for Replication

Context

- Companies source from farmers far from headquarters

- Farmers do not have nearby access to several services

- Companies have underutilized infrastructure (e.g., warehouses) in the agricultural areas they source from

Best Practices

- The offered services should be complementary to each other (and not competing) to enrich the value proposition

- A Farmer Management Information System support partner companies to benefit from shared data

- The hub can be complemented with last-mile strategies (e.g., agent network) to ensure effective service delivery

- Adequate fees system ensures transparency and balanced distribution of value, costs, and risks between hub owner and partners

Enabling Conditions

- The hub owner must have the required infrastructure

- Availability of high-quality service providers interested to participate in the hub

- Large farms and/or contiguous plots are required for some services to be feasible (e.g., mechanization, irrigation)

Business Case

(Expected) Outcomes for Afro-Kai Limited

Diversified revenues

AKL has a new source of income from the hubs’ fees system. Due to those fees, in the last 2 (two) years AKL increased the revenues of its storage and processing facilities by 26% in Purongo, and by 16% in Kasese. At that rate, the hubs are projected to be financially self-sufficient by 2025.

Expanded trading capacity

By revamping the hubs’ offer, AKL has increased its aggregated volumes in Purongo by 25% and in Kasese by 10%. In turn, these larger volumes increased the usage of the hubs’ processing capacity from 5% to 25% in Purongo, and from 5% to 10% in Kasese. These improved aggregation and processing capacities contribute to AKL’s ambition of expanding regional trading.

Business Case

(Expected) Outcomes for Service Providers and Agents

Benefits for partners

By participating in AKL’s hubs, other service providers have access to new customer segments and margins without incurring in major investments (i.e., infrastructure, marketing, agent networks). For example, by selling through AKL’s hubs, FICA Seeds (an AKL’s sister company) has increased their sales of maize seeds by 7% and sorghum seeds by 12%.

More income for local agents

Agents from AKL’s network earn commissions by delivering products and services offered at the hubs. These commissions can be additional to other sources of income agents may already have. For instance, FICA Seeds pays them 500 UGX per kg of delivered seeds, whereas AKL pays them 30 UGX per kg of aggregated produce.

Impact Case

(Expected) Outcomes for smallholder farmers

Increased access to services

AKL hubs allow farmers to access a nearer, timelier, and broader service offer. Owing to the implementation of the service hubs, farmers now can access 4 more services in Purongo area (i.e., quality seeds, mechanization, financial services, agronomy advisory, agri-inputs) and 3 more services in Kasese area (i.e., quality seeds, agronomy advisory, and financial services).

Outstanding Risks and Challenges

- The dynamics of the hub can be compromised if there are not active transactions with a large pool of farmers to attract new partners and services

- Hub partners may have reservations about sharing data with other companies

- Smooth collaboration in the hub may require close(r) relationships between the hub owner and the other partner companies

- It might be unclear how to establish an adequate fees system that ensures a right distribution of benefits and risks, as well as the hub’s financial sustainability

- Unbalanced value capturing can discourage some companies to partake in the hub

- Bundling and cross-selling services might be beneficial for the hub partners; however, the hub owner may find unclear how to design, kick-off, and coordinate that strategy

- Too high rotation of partners may lower the hub’s value to the farmers

Data Sources & Disclamer

Information is based on IDH’s Service Delivery Model (SDM) analysis for AKL, including data from AKL and 431 farmers (information is available on our methodology for SDM Analyses and Farmer Surveys). Additionally, interviews with company, agents, and farmers have been held since the start of Technical Assistance (2022) during which the innovation is tested and scaled. A longer time span and additional data are needed to verify and quantify impacts. Farmfit will conduct an end-line assessment of the company’s SDM and farmer livelihoods based on a repeat data collection at company and farm level.

Your Insights Hub journey has just started

Sign up here for access to updates - and industry insights and innovation - from the Smallholder Inclusive Business Newsletter.