Customer Focus Brings Green Technology to Rural Women in India

Customer-centricity requires thoughtful research and planning to understand people's wants, needs, and realities when it comes to their financial lives and beyond. Sistema.bio in India uses a customer-centric approach to offer rural women biodigesters at affordable prices using carbon credits.

Meeting women’s financial needs and specific challenges is especially important

Customer-centricity is particularly crucial for women because it also addresses the many competing intersections of their lives, including the gendered social norms that impact women's economic empowerment. Through thoughtful customer research and design, financial inclusion efforts can address various nexuses, including gender, climate, and financial inclusion. Onboarding/ adoption/ usage journeys can require an unrealistic amount of time and energy for women who are already overburdened with household and agricultural duties. However, a customer-centric approach is wider than a single FSP or company and often involves several partners coordinating to ensure a seamless process for end users – which is not easy when partners have competing priorities.

While not easy, customer centricity can help providers unlock opportunities for women who remain less financially, digitally, and economically connected than men. Understanding their lived realities and creating products and services that address their needs unlocks a significant market opportunity.

The Sistema.bio model

Sistema.bio, part of ABERA’s first cohort, is a biodigester company in India that enables rural households to transform organic waste (cow dung) into renewable biogas (clean cooking gas) and organic fertilizer, with around 75-80% of biodigesters handled by women.

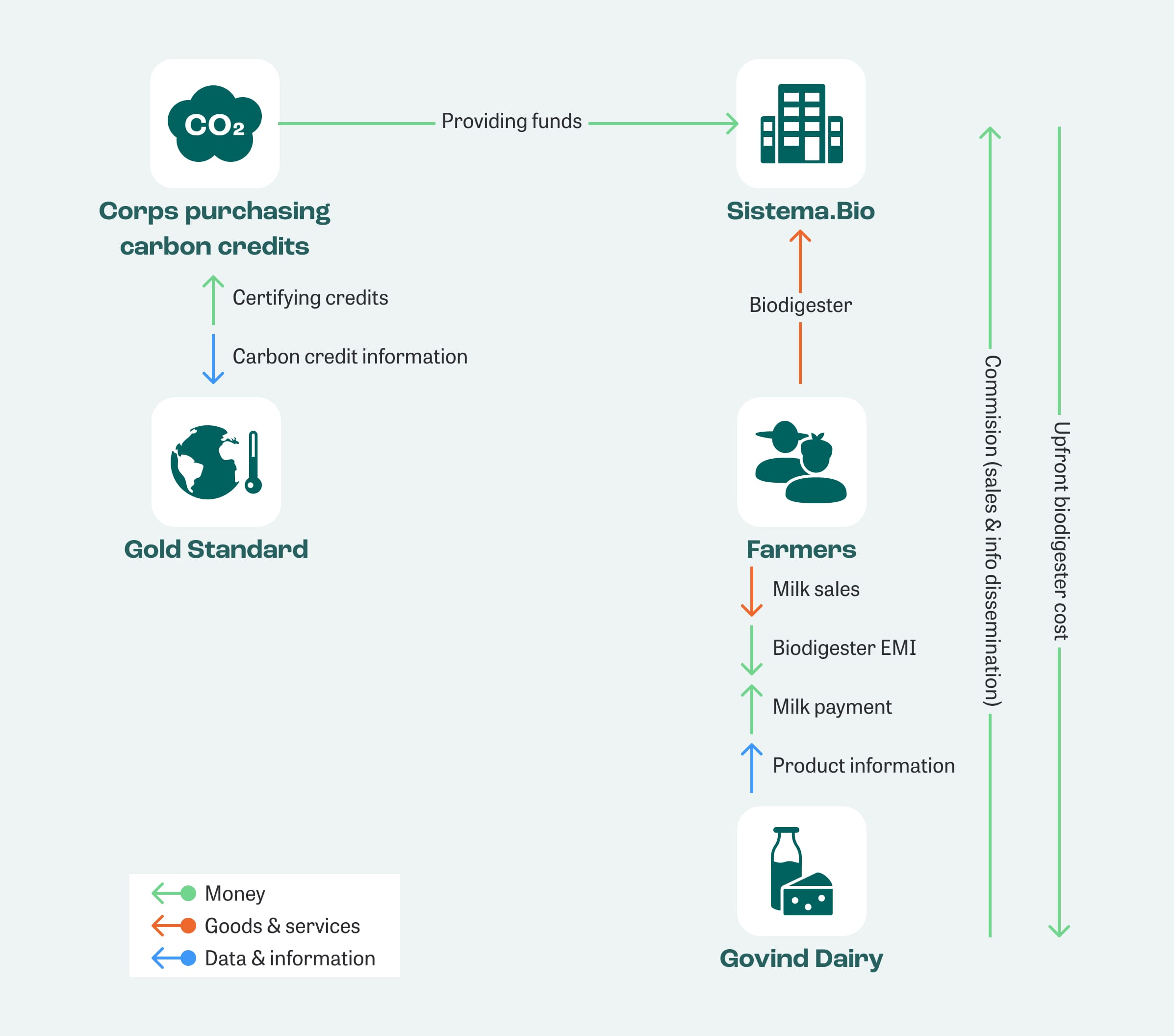

One of Sistema.bio's services targets households working in dairy, which include five key stakeholders: Corporates (who sponsor the project), Sistema.bio (the technology partner), Gold Standard (the carbon registry that validates and registers the projects, audits through third parties, and issues credits that corporations retire to meet their sustainability objective), the dairy network for reaching farmers at scale, and, at the center, the farmer. As illustrated below, Govind Dairy, a dairy network partner, recommends farmers they work with who they feel would benefit from a biodigester to Sistema.bio. Sistema then installs the biodigester, and certifies each household's carbon credits with Gold Standard, using these credits to subsidize the biodigesters by 60-90%, depending on the carbon credit market. The remaining 10-40% (around 60-140 USD) is loaned to the farmers by Govind Dairy, with the farmers’ repayments directly debited from their 10-day milk payments. Farmers typically pay off the cost of the biodigester within one to three months. Sistema.bio pays Govind Dairy a promotion fee for every biodigester sold, as well as their role in convening women farmers and providing ongoing information to farmers.

Govind Foundation (Govind Dairy’s philanthropic arm) has spearheaded this women’s economic empowerment program, which uses a blended finance approach, and means that farmers are offered cost-effective solutions. By working closely with farmers, and co-developing creative solutions, Govind was able to optimize existing resources for farmer growth and development. Given that women are active in 80% of dairy farming households, the foundation runs programs focused specifically on women. Govind provides a trusted face, regular training through their extension committee, exposure to new farming practices, and has even offered financial services such as emergency health loans against milk payments. This value is recognized by farmers through their loyalty – over 75% of milk farmers sell to Govind, largely because of the services and extra support they offer farmers.

This arrangement means that while farmers are the central point of the equation, they only need to interact with one partner. They are aware of the value of their carbon credits, but this is directly deducted from the cost of their biodigester, which after just four weeks of filling provides them with 3.5 hours of biogas a day and organic fertilizer, saving the average household 7.5% of their income annually. Beyond cost savings, this model also provides other benefits, including:

- An easy repayment model, with the cost automatically deducted from the farmer’s 10-day milk payments across anywhere from one to five payments

- A biodigester subsidized by 60-90% (of 450 USD as the total price), paid for through carbon credits generated due to a saving in carbon emissions caused by conventional fuel

- Financial training through Govind Dairy, and the ability to borrow against future milk payments for emergencies (i.e., a health issue)

- Peer support and learning opportunities for women’s groups (for example, Govind Dairy recently organized a group of women dairy farmers from Phaltan to travel to the Punjab to learn from another dairy cooperative)

- Access to on-demand demonstrations (the village head and Govind Dairy rep has a biodigester at his home so dairy farmers can come and see how it works and ask questions – if they are interested, he contacts Sistema.bio on their behalf)

From the lender’s perspective (Govind Dairy), collecting biodigester repayments from the farmers is hassle-free – the direct deduction requires no chasing, defaults, or additional costly administration. Govind also receives payment directly into its bank account every 10 days for the milk it supplies.

For customer-centricity to work, users need to have confidence in the system. If farmers don’t trust the partner/s they are working with, it is hard to see how they will adopt new technologies and adapt their behaviors. Govind Dairy offers a stellar example of a farmer-first model, designing financial products and interactions that truly resonate with women farmers’ financial and broader lives. ABERA’s partnership with Sistema.bio will now move to the next phase, where we distill findings from this initial assessment and work with Sistema to enact some of the emerging recommendations. As we move forward, we’ll be exploring questions like:

- Is there a way for Sistema.bio to offer competitive pricing without the carbon credit?

- What activities should a broader gender and climate strategy include for Sistema.bio?

As we continue this journey, it’s clear that the future of financial services lies in models like these — where understanding and meeting the specific needs of women isn’t just good ethics, but good business.

This article first appeared on the CGAP website

Related Resources

Your Insights Hub journey has just started

Sign up here for access to updates - and industry insights and innovation - from the Smallholder Inclusive Business Newsletter.