Aldea’s Digital Service Solution: Bridging Technology and Agriculture to Empower Smallholder Farmers

What is the innovation?

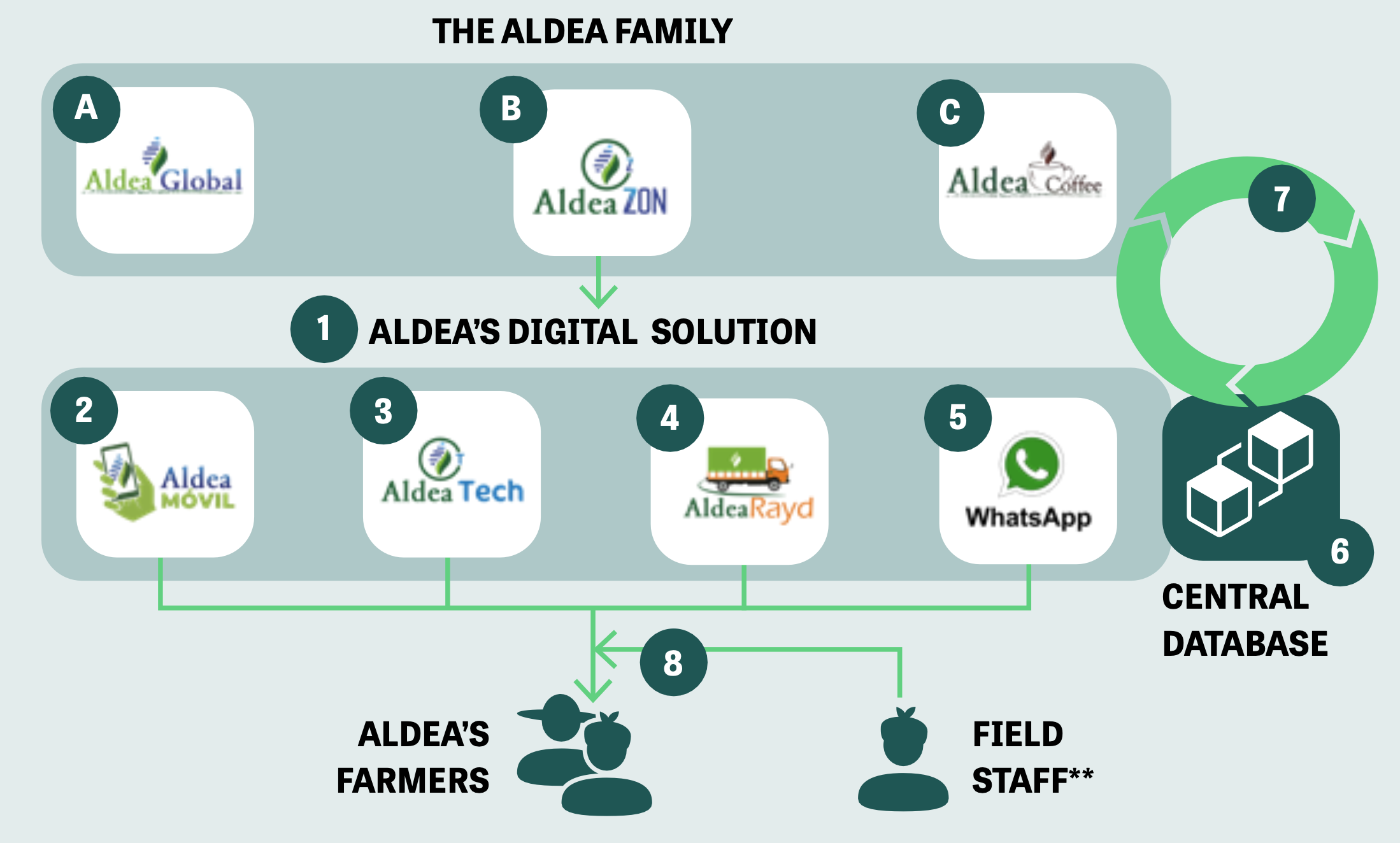

The solution is a digital “one stop shop”, owned and operated by an organisation, offering a holistic selection of complementary services to farmers. Utilising different in-house digital applications and WhatsApp, the digital service solution integrates and improves farmers’ access to finance, products, services, markets, information and technical assistance and allows the organisation to create efficiencies and make informed decisions.

Key challenges addressed

The Aldea Family¹ (“Aldea”) is a farmer-led organisation specialising in credit, agricultural input, processing and trading services, and technical advice. Due to the manual and paper-based approach to data collection and management, and the lack of a central database, information was inefficiently handled limiting Aldea’s ability to make data-informed decisions. Furthermore, farmers’ remote and dispersed locations complicated Aldea’s ability to provide extension services and collect the farmer and crop data necessary to control coffee quality and meet traceability demands. In 2011, Aldea therefore started with the incorporation of Information and Communications Technology (“ICT”) tools for data entry and process automation for its credit application process. Since then, Aldea has further built its digitally integrated value chain offering, improving data management, efficiencies and data-informed decision-making, and utilising farmers’ smartphones to provide farmers with tailored and timely services.

How it works?

- Aldea Global is an MFI, which provides financial services, offering credit loans to farmers

- AldeaZON provides input services, offering fertilizers, chemicals and equipment, including the delivery of the inputs to farmers

- Aldea Coffee provides trade, processing and marketing services, facilitating the processing, exportation and sale of coffee

- Aldea owns, operates, and manages the digital solution and its applications (excl. WhatsApp)

-

Aldea Móvil app farmers:

- can track their finances and details of their loan(s) at Aldea Global

- can request inputs, fertilizers, chemicals and equipment and have insight in their orders at AldeaZON

- have insights in the details of their coffee sales (e.g. #bags sold; sales price) to Aldea Coffee

- AldeaTech app: Aldea Coffee offers farmers technical advice on Good Agricultura Practices (“GAPs”)

- AldeaRayd*: Aldea Coffee links farmers to third party transporters in the area, and directs the transporters to the nearest storage

- WhatsApp is used throughout the Aldea Family and is used for day-to-day communication with farmers.

- Data collected in Aldea’s applications is linked to individual farmer IDs and stored in the central database

- Data from the database feeds back into the three businesses in the Aldea Family to facilitate data-informed decision making and improve tailored service offerings

- Field staff** signs up farmers and provide support next to services provided through applications

Note: all services offered by Aldea Global, AldeaZON and Aldea Coffee can also be accessed without mobile phone through the field staff

*AldeaRayd is still in pilot phase; **Field staff can be loan officers, promoters or branch staff

Tips for replication

Context

- Farmers are dispersed and live in remote areas, with limited access to affordable and quality finance, services and inputs

- A farmer-led organisational structure with offline service offerings and longstanding relationships with farmers are in place

Best Practices

- A bottom-up approach – utilise the local ownership structure and self-regulating characteristics of farmer-led organisations & cooperatives to delegate activities and responsibilities

- A customer-centred approach – use information and data to identify

and predict farmer needs, and to continuously improve and develop

solutions that improve (digital) farmer services - Holistic service selection – offer multiple services that complement each

other to increase adoption by farmers and allow for integration of data - Building own solutions in one cloud data centre, the source code owned

by the organisation, improves control and interoperability between

different solutions - Pair the digital solution with human intermediation. This establishes

and maintains farmer trust, while ensuring that clients meeting eligibility

criteria, reducing the risk of fraud and adverse selection - The organisation requires management with a strong vision on ICT,

data and technology

Enabling Conditions

- Sufficient penetration of mobile phones amongst farmers

- Suitable cloud services and technologies are available

Business Case

(Expected) Outcomes for The Aldea Family

Data-driven decision-making & efficiencies

The integration of the different digital solution applications facilitates data-informed decision-making, improves operational efficiencies and enables scale. For example, using the farmer data collected, Aldea created a credit scoring tool which pre-approves loans for clients with an excellent credit record, reducing loan approval time from 10 to 4 days. Aldea wants to further reduce this to 2-3 days, and by 2029, Aldea aims to evaluate 40% of member credit requests through an algorithm. Also, the database facilitates forecasting of farmer input and financing needs, enabling Aldea to buy inputs in bulk, lowering costs, and predicting when farmers need what type of financing. Moreover, the different applications allow Aldea to reach more farmers, faster.

Crop quality, traceability & income

Availability of data facilitates improved traceability and quality monitoring of coffee, ensuring more of Aldea’s coffee farmers meet certification criteria and can be sold as “speciality coffee”, at a premium of ~USD15-30 compared to commercial trade coffee². In the 2021/2022 season, Aldea exported a total of ~450 containers³ of coffee, of which ~40% was speciality coffee. By 2027/2028 Aldea hopes to almost double it’s annual coffee exports to ~800 containers³, with 60% being speciality coffee.

Reduced credit & fraud risk

In June 2024 Aldea had a PAR30 of 1,8%, compared to a PAR30 of 3.4% of small MFIs in Nicaragua in March 2024⁴. Because of the data on farmer crop financing needs and ability to better predict client behaviour, Aldea is able to reduce its credit and fraud risk. The combination with its strong physical presence and offering a set of complementary services, further reduces the incentives for farmers to default.

Business resilience

Aldea’s strong and integrated technological strategy and approach has demonstrated to improve Aldea’ business’s resilience. During the COVID-19 pandemic, Aldea continued its business as usual and didn’t have to pause its services, as its processes and systems were already set-up to facilitate remote and online work. This is demonstrated, for example, by Aldea’s growth in financial services. Aldea went from ~7k active borrowers in Q2 2021 to ~10k active borrowers in Q3 2024, showing a ~35% increase⁵.

Impact Case

(Expected) Outcomes for Smallholder farmers

Improved farming practices & performance

~75% of smallholders surveyed by Aldea in 2023 indicated to have improved their understanding and application of GAPs due to technical advice provided through WhatsApp⁶. 55-75% of surveyed farmers indicated to have noticed significant yield and quality improvements of their coffee plantations.

Access to services, facilitating inclusion

The applications facilitate remote access to a broad range of services (a.i. financial, input, transport, technical advice) at a time convenient for each farmer. For example, among farmers surveyed by Aldea, women farmers pointed out that accessing technical advice through the app is especially valuable for them, as they are often too busy with household responsibilities to attend trainings.

Input accessibility and affordability

Because Aldea can predict farmers input needs, it can buy in bulk and apply the “Just In Time” inventory method, resulting in lower costs. Consequently, farmers can purchase high-quality inputs from Aldea at prices competitive with other input providers, who generally offer lower quality. To stimulate use of the digital applications, farmers purchasing inputs via the application experience a small additional discount of ~1-3%. Moreover, Aldea offers farmers the option to buy inputs on credit, improving input accessibility and affordability.

Improved transparency

Through the applications, farmers have access to the details of their interactions with Aldea, improving transparency. For example, through the Aldea Móvill app, farmers have insights into the number of coffee bags and price per coffee bag sold to Aldea Coffee, the conditions and status of their loan from Aldea Global and the status of their inputs order at AldeaZON.

Outstanding Risks & Challanges

- Bad internet coverage at farms and limited digital literacy among older farmers are slowing down the adoption of applications. To tackle this, Aldea is creating an offline function of the application and offers trainings on how to use the applications.

- With Aldea capturing more and more (sensitive) data, robust data systems and governance need to be in place to ensure data quality control, management and security.

- Due to Aldea’s remote office location, attracting skilled personnel for the digital strategy implementation can be challenging. Moreover, as Aldea continues to grow and innovate, it needs to ensure its existing staff stays up-to-date too. To address these challenges, Aldea is recruiting and training staff locally (e.g. adult children of farmers), ensures staff continues to develop itself by providing access to the necessary (online) trainings, and promotes remote working options, facilitated by its digital approach. To facilitate further growth, Aldea is currently looking for an experienced Chief Technical Officer.

- Aldea aims to further integrate data linkages between services and applications , improving service offerings tailored to farmer specific characteristics such as geographical location, crop type and the stage of the crop cycle.

The role of Finance providers

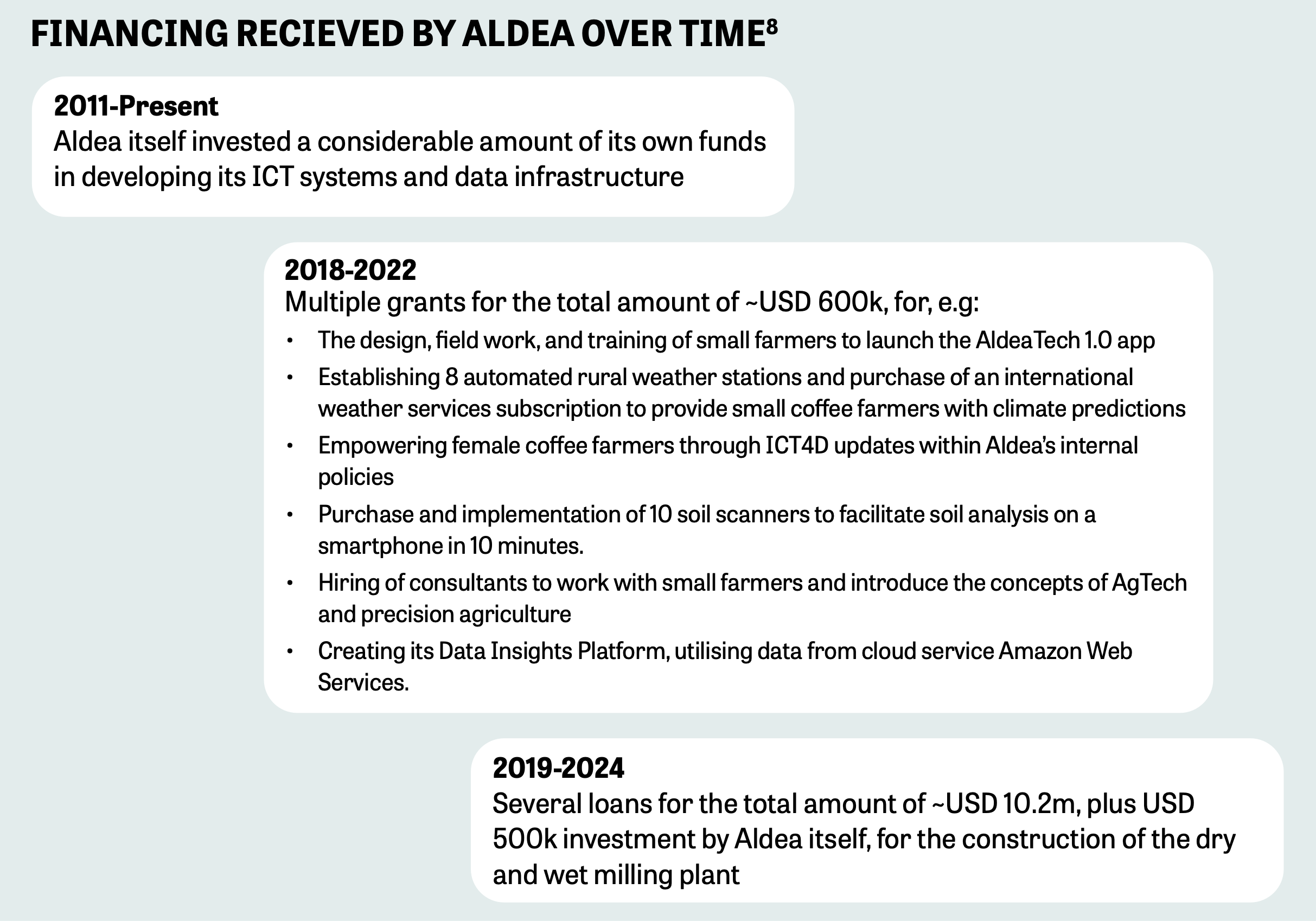

Throughout the years, attracted financing from several impact and development focused finance providers⁷ (“FP”) for a variety of its (digital) business developments (see timeline).

IDH Farmfit Fund ("Fund")

(Expected) Impact of (Non-)Financial Support

Note: unless otherwise specified, below impact is attributable to all finance providers

Catalytic effect

Aldea emphasised the catalytic effect – by committing finance and taking a risk, early financiers created trust in Aldea’s business, crowding in other finance providers. This includes commercial banks, who previously weren’t interested in providing financing to Aldea due to small ticket sizes and the lack of a guarantee.

Innovation & business growth

The financing made available by impact and development focused FPs gave Aldea room to innovate, such as the digital service solution, which enabled Aldea to grow its business, and expand and improve its service delivery to smallholder farmers.

Better business practices

The FPs brought experience and expectations that steered and supported Aldea to improve its business practices. E.g., the IDH Farmfit Fund supported Aldea with improving its E&S risk management and Rabobank shared technology knowledge that allowed Aldea to develop some of its digital tools. Aldea also learned from interacting with the FPs - the way they do things and view things, the questions they ask, helped Aldea think about its business differently and create new ideas.

Reduced investor coordination

For different parts of its business, Aldea has 15+ lenders for relatively small loan amounts. Constructions where investors team up, like the joint investment in the coffee milling plant by Oikocredit and the IDH Farmfit Fund, simplify the coordination of investors for Aldea.

Dry/wet milling plant construction

The construction and implementation of its own technologically advanced coffee milling facility allows Aldea to:

- increase its processing capacity with ~70% in a cost-efficient way, compared to when it was renting several different milling plants

- bring in the de-pulping and fermentation process otherwise performed by farmers, improving quality and post-harvest weight maximization

- increasing farmer yields with an estimated ~8%

- Generating ~38% additional income for Aldea and its members, which is equivalent to additional payment to farmers of ~11% per 100lbs delivered to Aldea for processing

- improve environmental practices, reducing risk of non-compliance as well as reducing costs resulting from better resource efficiencies

Take a look at the plant in this video

Data Sources & Disclaimer

Information is based on data and documentation gathered by the IDH Farmfit Fund during the Investment Process (including Due Diligence) and Monitoring Calls and Visits. Additionally, interviews with farmers and company representatives have been held since the start of the first investment (2021). A longer time span and additional data are needed to verify and quantify impacts. This will require an end-line assessment of the company’s IB and farmer livelihoods based on a repeat data collection at company and farm level.

Footnotes:

- Despite not being formally organised as a holding company, these businesses share a common ownership structure that enables them to function as a cohesive unit. The Aldea Family is made up out of Aldea Global, Aldea Coffee and AldeaZON: https://www.aldea-coffee.com

- Difference of the premium compared to commercial grade coffee depends on NY”C” coffee prices and just varies per year.

- A container equals approximately 418 quintiles, or 19k kg, or 19 tons

- Source: Redcamif

- no data available from before Q2

- Technical advice is tailored to each specific farmer based on a soil analysis. With soil scanners, field staff is able to analyse the soil within 10 minutes. Using an internal application, agents can advise farmers on the right inputs. On Sundays, tailored weather forecasts and climate-based activities advice is shared with the farmers.

- Bio-Invest, IDB Lab Inter-American Development Bank, IDH Farmfit Fund, Inter-American Foundation, Mennonite Economic Develoment Associates (MEDA), OikoCredit, Rabobank Foundation, responsAbility, TechnoServe (MOCCA program), Triodos Bank

- Over time, Aldea has received more financing than illustrated on this timeline. The timeline focusses specifically on financing provided related to the digital innovation.

In this article

Your Insights Hub journey has just started

Sign up here for access to updates - and industry insights and innovation - from the Smallholder Inclusive Business Newsletter.