Integrated End-to-end Traceability and AI Credit Scoring to Unlock Access to Finance

What is the Innovation?

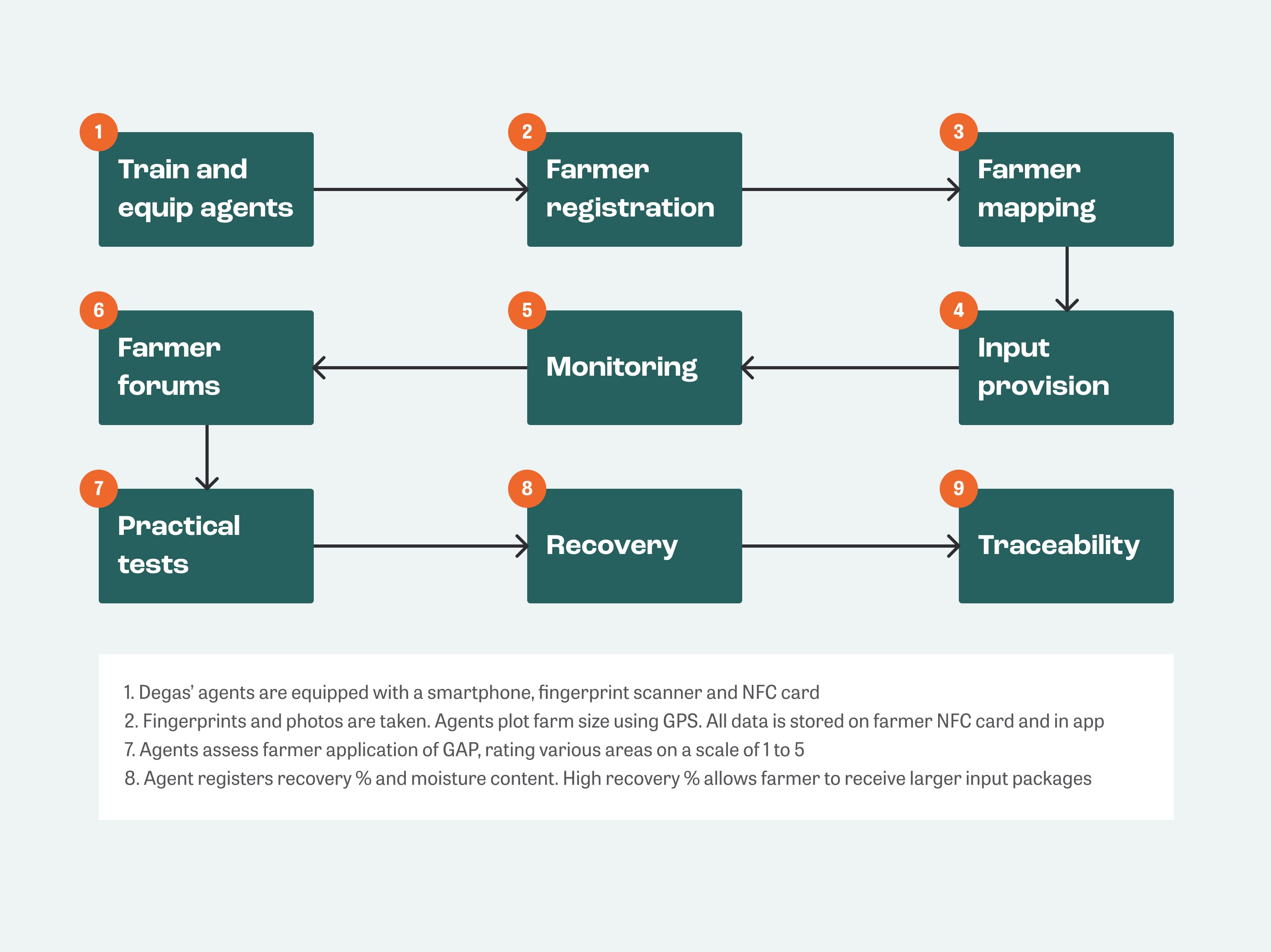

End-to-end traceability and AI credit scoring: Field agents, equipped with fingerprint scanners, smartphone with a pre-installed in-house developed app, and more, create a complete, verifiable and traceable profile of farm(er)s and produce. Data is stored in the app allowing digitization, aggregation and manipulation. Coupled with a proprietary AI credit scoring algorithm, the data is leveraged to predict non-performing loans (NPL) with very high accuracy. With scale and over time, the predictors of NPLs can be better understood.

Key Challenges Addressed

How it Works

Tips for Replication

Best Practices

- Relevant data: A lot of relevant data needs to be collected to fulfill different use cases, including personal data, training attendance, applied practices and recovery rates

- Data entry: Agents need to be appropriately trained and equipped to allow for on/offline data capture of all required data points

- Data management: The data infrastructure and the software needs to be designed with the end in mind, compliant to safety and privacy regulations, and flexible enough for continuous future updates

Enabling Conditions

- Scale: The accuracy and therefore added value of the model increases with larger scale, so (potential for) scale is crucial for success

- Premium market: In order to monetize traceable produce, there must be demand

- Available skills: Access to developers and tech savvy agents that possess relevant skills

Business Case

Outcomes for Degas Ltd.

Reduced credit risk

With the data Degas collects, they make an accurate prediction of the farmer’s ability to repay the credit provided by Degas. Only farmers with good credit scores (95-99%) are eligible for (more) inputs next season, thereby reducing the credit risk for Degas.

Access to premium markets

Degas’ model allows for full traceability per bag. This is not common in the sector, although there is increasing demand from buyers who are willing to pay a premium. Therefore Degas is able to tap into these premium markets.

Effective data collection

Degas’ extension staff are well-equipped and trained, leading to a high quality but high-cost model. They collect reliable farm-level data in an integral and continuous way. Degas might be able to monetize the data as many organizations are looking to learn what works in smallholder value chains.

Impact Case

Outcomes for smallholder farmers

Access to finance

By collecting and analyzing qualitative and quantitative farm level data, the (perceived) risk of providing financial services to smallholder farmers is decreased. This enables farmers to access crucial financial services like loans, but also insurance and pensions

Traceability premiums

Using QR-tags, each bag can be traced back to the individual farmer. Increasingly, buyers are willing to pay a premium for this level of traceability. This premiums can trickle down to farmers.

Increased productivity

By collecting and analyzing the extensive farm level data, service providers are able to tailor their service provision based on the needs and profile of individual farmers. This leads to optimized, tailored and cost-effective service provision, which in turn will benefit farmers through increased productivity.

Learn more about Degas’ model in this video

Data Sources & Disclaimer

Information is based on IDH’s Service Delivery Model (SDM) analysis for the Grains for Growth program, including data from Degas. Additionally, company interviews have been held since the start of Technical Assistance (2022) during which the innovation is tested and scaled. A longer time span and additional data are needed to verify and quantify impacts. Farmfit will conduct an end-line assessment of the company’s SDM and farmer livelihoods based on a repeat data collection at company and farm level.

Your Insights Hub journey has just started

Sign up here for access to updates - and industry insights and innovation - from the Smallholder Inclusive Business Newsletter.