Direct Cost Recovery from Services

What we mean by cost recovery

Greater private sector investment in smallholder agriculture is crucial for the sector’s viability. Showing a positive return on this investment is key to convincing companies and investors to scale up their investment. Direct cost recovery from services looks at the most direct way of getting a return on investment and is therefore a key indicator in the Insights Hub.

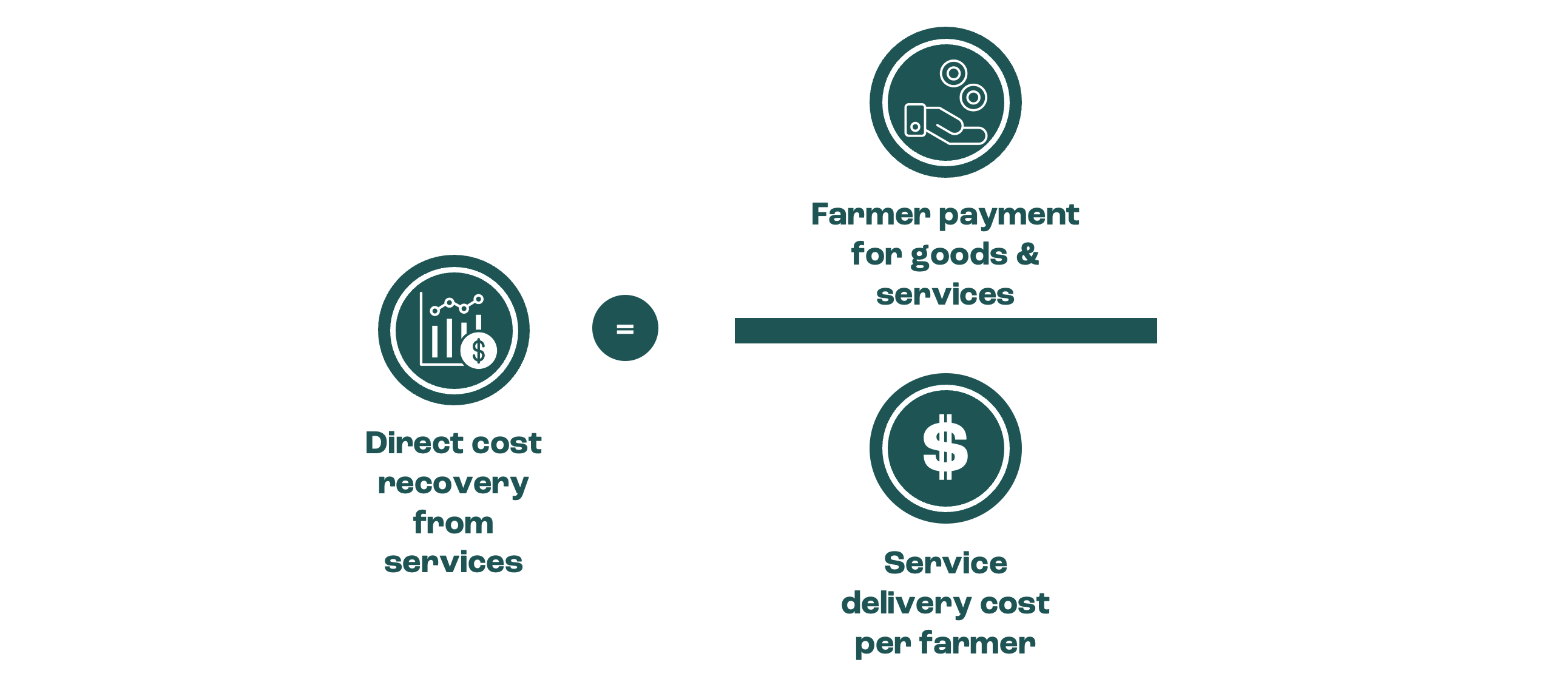

Direct cost recovery from services refers to the proportion of a company’s service delivery cost to smallholder farmers that companies are able to recover through service revenues.

Want more detail on how we define direct cost recovery?

Our data on over 100 business models shows a huge spread in services-led cost recovery. Figures range from a minimum of 0% to a maximum of 137%, with mean and median values of 44% and 33%, respectively.

Among the many benefits of studying this indicator, there are two that are key to highlight:

Firstly, understanding direct cost recovery can help us better understand individual smallholder-inclusive business models. The main motivator for companies and investors to invest is to achieve a return on their investment. The most direct way of doing so is to directly charge customers – in this case smallholder farmers – for the goods and services provided to them. Knowing how much of its costs a company can recover by charging for services helps to highlight the remaining subsidy that would need to be covered from other sources.

Secondly, we hope that by providing initial insights on direct cost recovery, FarmFit will help change perceptions of investing in smallholder farmers. A widely-held perception in the sector is that service provision to smallholder farmers is, almost by default, a loss-making venture requiring large public, development, philanthropic and CSR subsidies. Due to a lack of credible and comparable data, there is very little visibility and comparability on the return to companies of their investments in service delivery to smallholder farmers. As we have seen in the New Paradigm section, there is a massive need for increasing private sector investment in smallholder farmers and we are optimistic that our work will help us move towards this new paradigm.

There exists a range of more specific benefits to studying and understanding direct cost recovery that differ for different types of organizations, including:

- Benchmark cost recovery against peers

- Identify opportunities for increasing your cost recovery rates, either by increasing farmer payments or driving operational efficiencies, through business model design options or adapting to context

- Optimize and balance business model outcomes, including cost recovery, gross investment per farmer and farmer value creation (the three outcomes we focus on in the initial set of Insights Hub publications)

- Make the case – internally or externally to funders – for increased investment to enable increased cost recovery in farmer goods and services. Our data suggests that higher cost recovery is linked to higher rather than lower investments

- Set accurate, feasible and relevant internal targets around cost recovery

- Determine companies’ investability by comparing their financial performance, knowing that cost recovery is the most direct way for companies to make a return on their investment in smallholder farmers. Use our Data Explorer to see how companies in your portfolio or pipeline perform on cost recovery compared against their peers

- Provide input for periodic performance measurement and benchmarking of investees to help them on a path towards commercial viability of service delivery

- Inform geographic or sectoral investment strategies by better understanding context-specific determinants and drivers of cost recovery. We have seen that cost recovery rates differ significantly depending on the context, such as type of provider (global or local offtaker) and crop type (food or cash)

- Building on this data, start a broader conversation with your investees on the return of their investments in smallholder farmers. What are the sources of value that they expect to receive from their interventions? Are they able to measure these? Are there opportunities to increase this value by either increasing farmer payments or driving operational efficiencies?

- Identify and assess what business models to support based on potential pockets of non-commercial viability (i.e., less than 100% cost recovery). These may indicate market failures, i.e., instances where there might not be a positive business case for the private sector to engage.

- Provide input to a toolkit of support interventions that can help supported companies optimize cost recovery

- Provide insights into how (finite) development and philanthropic capital can be best allocated in contexts (e.g., geographic, farmer segments, types of services) where cost recovery is lower than others. Use our Data Explorer to identify contexts or business model types where support requirements may vary

- Help identify grant, philanthropic and/or public investments to put in place measures that can help reduce gross investments per farmer in a specific context (country, region, crop). Examples would be around infrastructure that would reduce last mile delivery costs (e.g., promoting agent models, organizing farmers) in close collaboration with the private sector

Our insights on direct cost recovery

There is a huge spread in direct cost recovery for the 100+ models that FarmFit has analyzed, ranging from no cost recovery at all to well over 100%. To date, the Insights Hub has found the most interesting relationship to exist between direct cost recovery and the following

Other outcomes

Contextual Drivers

Design Drivers

Your Insights Hub journey has just started

Sign up here for access to updates - and industry insights and innovation - from the Smallholder Inclusive Business Newsletter.